ELEVATE YOUR BUSINESS WITH CUSTOM PAYMENT PROCESSING & STRATEGIC GROWTH SUPPORT

Operating in a complex or restricted vertical? Partner with KingsEdge to access specialized payment processing and media solutions built for scale and consistency.

Hello, I’m the Founder of KingsEdge

I started KingsEdge because I know first-hand how exhausting it can be when traditional providers turn away businesses operating in the so-called “grey” area. Instead of navigating constant rejections, opaque fees, and compliance nightmares, you deserve a trusted ally who gets your industry—and believes in your potential.

Services

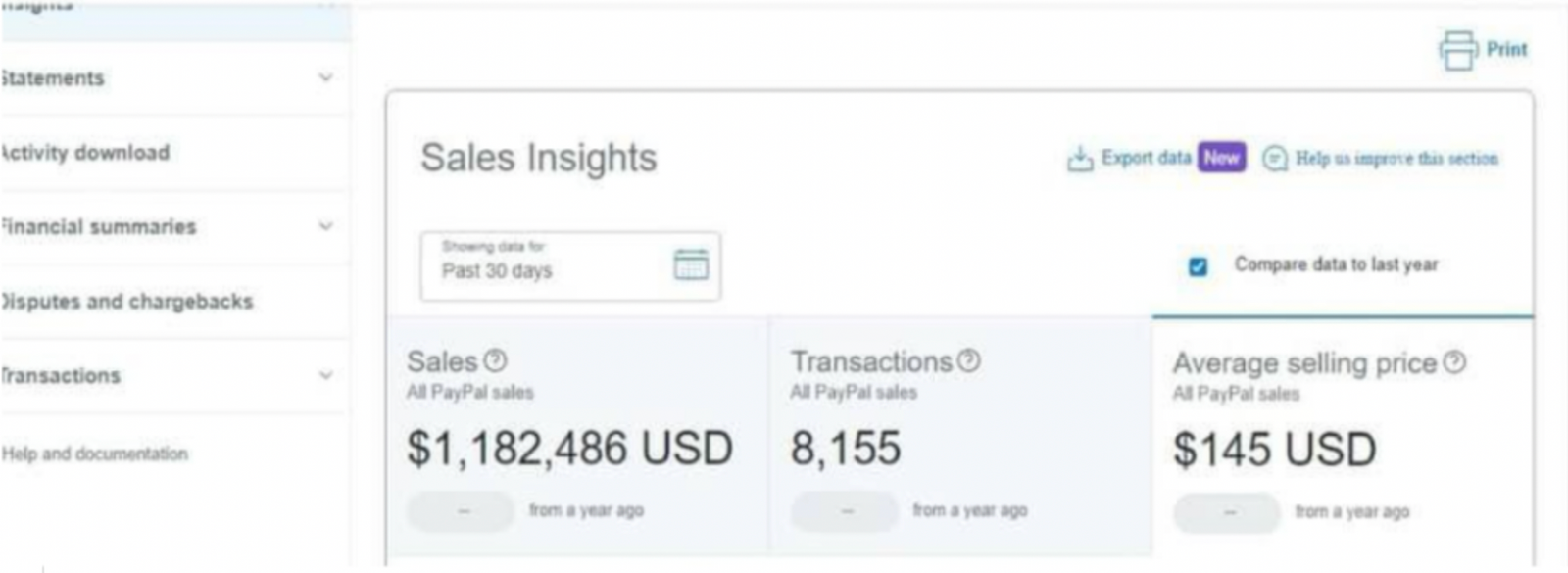

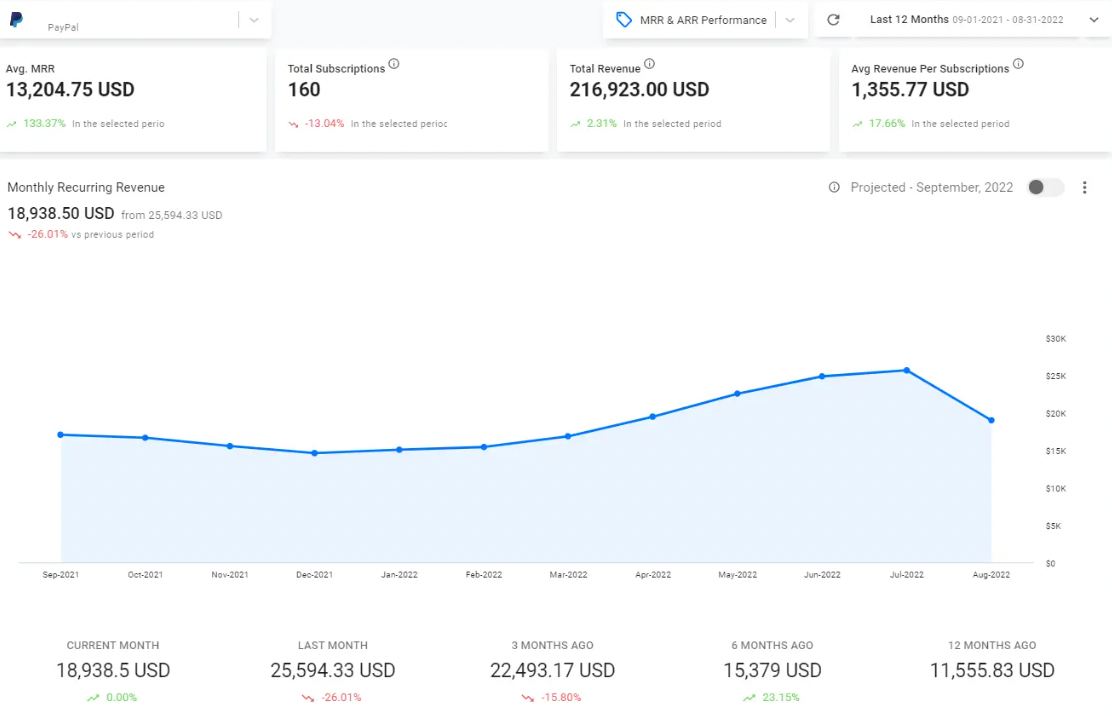

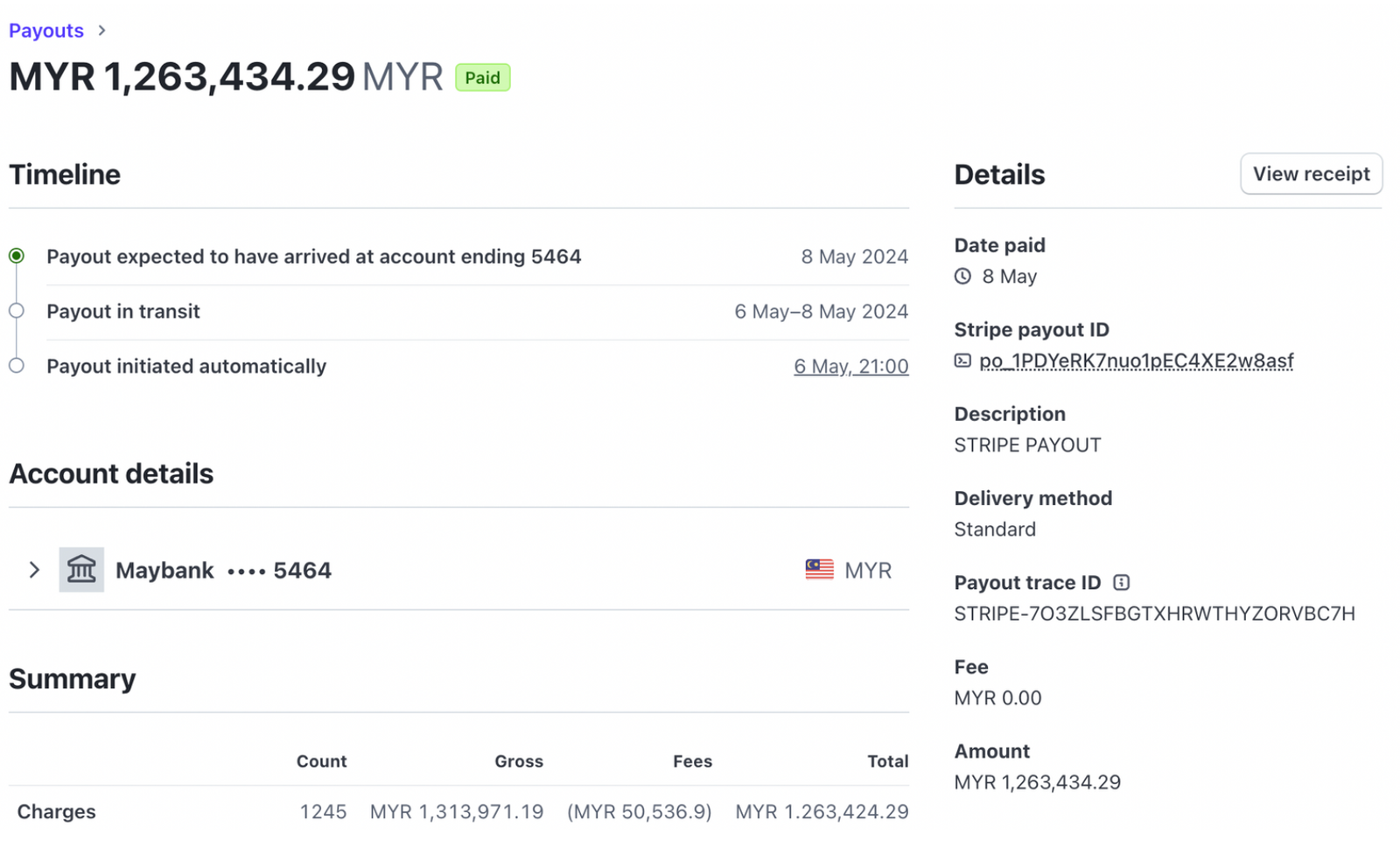

High-Risk Payment Processing

- Custom merchant accounts built for businesses that don’t fit mainstream processor guidelines.

- Reliable, private gateways engineered to keep your transactions flowing without disruption.

Consultation & Strategy

- One-on-one guidance to minimize chargebacks, stay operational, and plan for sustained growth.

- Tailored advisory for unique business models — because no two ventures are alike.

Meta Ad Account Solutions

- Unlimited high-risk Meta ad accounts for aggressive advertisers who need scale, stability, and zero downtime.

- Recovery and protection support for banned, flagged, or restricted campaigns — stay live, compliant, and scaling without limits.

Our Solutions

AltVault

- Multi-Currency Support

- Non-USD card options

Sectors We Fuel

Replica & Brand-Adjacent Products

- We support merchants blocked by mainstream processors due to perceived brand risk or legal gray areas.

Mushrooms & Alternative Wellness

- From functional mushrooms to plant compounds, we enable processing for emerging health verticals with complex regulations.

CBD & Hemp-Based Goods

- We navigate federal and regional compliance concerns to ensure stable CBD payment access.

IPTV & Subscription Media

- Maintain subscription continuity with processors that understand the volatility of streaming, licensing, and chargeback risks.

Casino, eGaming & Sweepstakes

- Our network supports operators dealing with AML scrutiny, volume volatility, and layered compliance demands.

Social Media Engagement Providers

- We support performance-based services often flagged as high-risk by default processors.

How KingsEdge Alleviates Your Pain Points

01. Purpose-Built Payment Channels

We work only with processors who specialize in non-traditional business models — no random shutdowns, no one-size-fits-all.

02. Transparent, Predictable Pricing

You get clear, direct pricing — no inflated percentages, hidden reserves, or vague terms.

03. Streamlined KYC & Onboarding

Our KYC systems are built to move — even with risk flags. We get you approved and live fast.

04. Legal Alignment & Chargeback Mitigation

From terms structuring to dispute defense, we help keep your accounts protected and your funds flowing.

05. Fulfillment & Paid Media Infrastructure

Connect with vetted fulfillment partners and run ads using stable Meta infrastructure — complete with recovery support.

06. Built for Long-Term Scale

We don’t just get you processing — we keep you scaling with the backend systems, contacts, and planning no other provider offers.

Contact Us

Ready to secure a reliable payment infrastructure and grow your ‘grey’ business without constant

roadblocks? Let’s talk one-on-one

+447520602035

Telegram

Contact Us

“Ready to secure a reliable payment infrastructure and grow your ‘grey’ business without constant

roadblocks? Let’s talk one-on-one